It is important that all individuals with an annual income of PKR 600,000 or above must file their tax returns in Pakistan.

You’re in luck if you believe your yearly income to be above this limit and you haven’t filed taxes yet.

Here, we discuss the step-by-step process of becoming a tax filer in Pakistan. Filers of income taxes in Pakistan can also take advantage of other incentives, including duty contracts and tax exemptions.

Whether you’re a salaried employee or a business owner, submitting your tax return via the Federal Board of Revenue (FBR) portal can save you time and hassle.

The FBR’s online system, known as Iris, allows taxpayers to file returns easily from the comfort of their homes.

Let’s get started.

Step-by-Step Process to File Income Tax Return Online in Pakistan?

Here is a simple process to file income tax returns online:

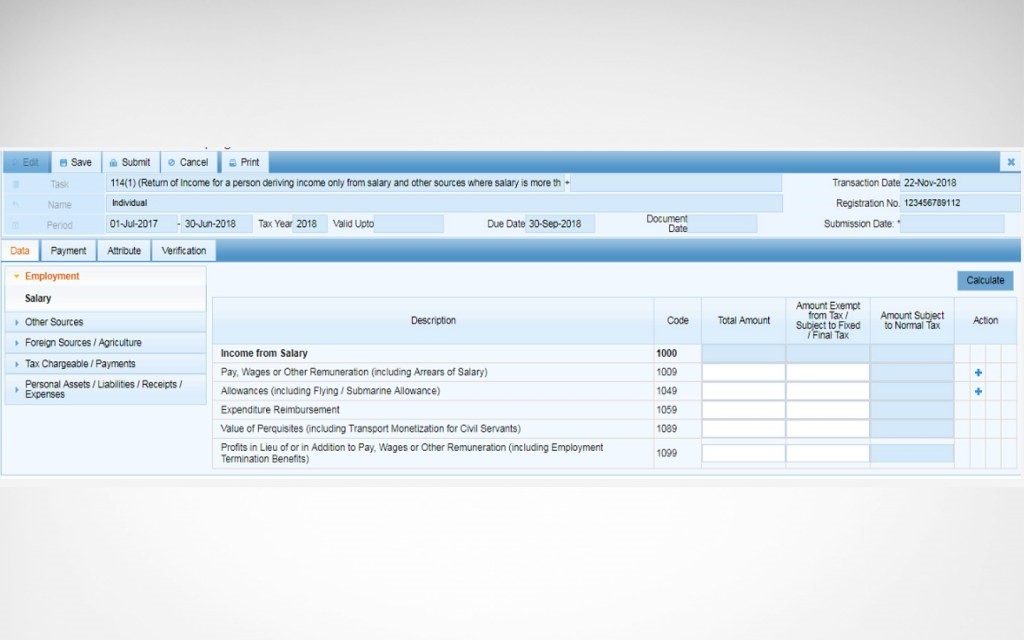

Login to Iris Portal and File Income Tax Return

- Visit the Federal Board of Revenue website. Enter your username and password.

- If you forgot your password, click on the forgot password and reset it.

- After login, go to the “declaration” menu on top of the portal

- Click on the Period tab, where you have to enter the Tax year

- Go to the employment section

- Select Salary Tab

- Enter the annual income in salary in the Total Amount section

- If the amount you get from your salary is tax-free, please note it under the title “Amount exempt from tax.”

- Once you are done click on Calculate button

- Fill in the input fields with the total tax, the amount exempt from tax, and the amount subject to final tax, then click Calculate.

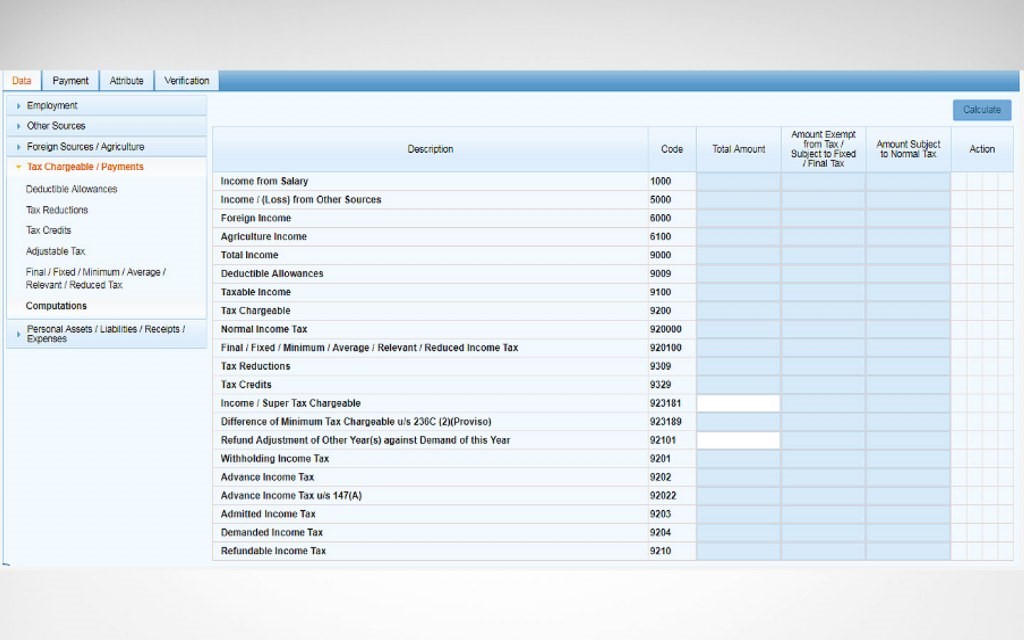

Tax Deduction Amount and Adjustable Tax

- Select the Deductible Allowances tab after selecting the Tax Chargeable/Payments option. Here, you can input any amount deducted for charitable donations or Zakat.

- Completing the fields for Adjustable Tax, Tax Credits, Tax Chargeable, and Tax Reductions

- You must enter the information about the taxes that you have already paid or been assessed during your tax year on the Adjustable Tax screen.

- If you work for the federal government, enter the tax amount that corresponds to the 64020001 code.

- If you work for the province government, enter the tax amount against 64020002.

- If you work for a corporation, input your tax amount against the 64020003 code.

- You can also change the tax deducted by your bank.

- You can change the tax that your bank deducts from motor vehicle registration fees, transfer fees, sales, and leasing by comparing them to the appropriate codes.

- A dialog box will show up requesting information about the car, such as its make, model, and engine capacity, as well as the E&TD Registration No. When you’re finished, select the Calculate Tab button.

Tax Payments

- All of your income and charged tax details will be displayed when you select the Tax Charged tab.

- Examine the Admitted Income Tax and Demanded Income Tax tabs.

- You must make payment and attach the necessary CPR if you discover any amount due under the Demanded Income Tax tab.

Relative Value

- Select the Personal Assets menu item to enter asset details.

Put the sum for both the current year’s net assets and those from the prior year. - In the inflows and outflows field, enter the annual income.

Once all the information has been entered, click the Calculate button. - When filing income tax returns, the “Unreconciled Amount” must be zero.

Acquiring the required tax payment

- Following the procedures below, you must submit the specifics of your returns after paying the demanded tax through the Alternative Delivery Channel (ADC) or in cash at any approved National Bank of Pakistan branch.

Click the plus sign in the upper right corner of the Payments tab after selecting it. - A dialog box requesting payment details will show up.

Input the CPR number. Click on the search option after entering the amount code or paid amount. - Once the whole list of your payment details appears, click the OK button to save it.

Verification and Submission

- Once you have added and calculated all required fields, you should now verify your identity.

- Enter the verification pin and click on the Verify Pin tab

- Once you are given the details, you can now file income tax returns by clicking on the Submit tab

This is a simple process on how to file income tax returns in Pakistan.

Who is not required to file an income tax return in Pakistan?

People who earn less than Rs 600,000 a year will still not be required to file tax reports.

How to file an income tax return in Pakistan for overseas?

Foreign Pakistanis must register with the FBR and obtain their NTN (National Tax Number) in order to file a tax return. You can accomplish this by registering online using the IRIS portal.

What is the penalty for not filing an income tax return in Pakistan?

Late filings are subject to fines from the FBR. There is a range of PKR 10,000 to PKR 50,000 for these punishments.

Furthermore, there will be a penalty based on the amount of tax due and the length of time the return is overdue. To reduce these fees, you must file your return as soon as feasible.

Wrap Up

By following the above-mentioned steps, you can easily register and submit your return through the FBR’s Iris portal.

However, with this online process, you can reduce your stress and ensure accuracy.