There are plenty of reasons we hold back from investing—it’s not just the busyness of daily life but also the fear that we need a lot of money to get started.

The reality is, you can begin investing with a small amount of money and still see significant returns. The key is to start early, ideally when you’re young, and to invest wisely, even on a small budget.

Ever wondered how people make money from the stock market without ever stepping foot in a financial office?

Well, investing in the Pakistan Stock Exchange (PSX) is now as easy as clicking a few buttons from the comfort of your home.

Investing in the stock market can seem daunting, but with the Pakistan Stock Exchange (PSX) now offering online trading, it’s easier than ever to start growing your wealth.

Let’s discuss the step-by-step process of investing in the PSX online, even if you’re a complete beginner.

However, whether you want to start small or dive deeper into the stock market it’s easier than you think!

What is Stock

A stock, also known as equity, represents ownership in a company. When you buy a stock, you’re essentially buying a small portion of that company’s assets and profits.

What is a stock market? Stock exchange? and a stock broker?

- Stock Market

A stock market is a platform where companies raise capital by issuing shares of stock to the public, and investors buy and sell those shares in hopes of earning a profit. It’s a place where supply and demand meet to determine the prices of stocks.

- Stock Exchange

A stock exchange is a physical or automatic platform where stocks are traded. It’s a marketplace where buyers and sellers meet to exchange shares of stock.

- Stock Broker

A stock broker is an intermediary between buyers and sellers in the stock market. They facilitate transactions, provide investment advice, and manage portfolios on behalf of their clients.

- Stock brokers can be individuals or companies, and they often work for brokerage companies or online trading platforms.

Difference Between Investing and Trading

Investing and trading are two distinct approaches to participating in the stock market.

Understanding the differences between them can help you make informed decisions about your financial goals.

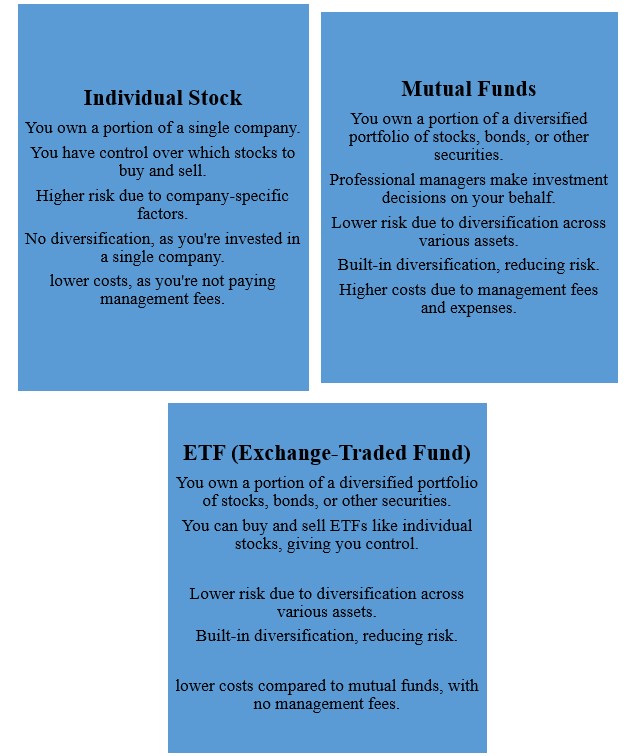

Individual Stock vs Mutual Funds vs ETF: What’s the Difference?

When it comes to investing in the stock market, you have several options to choose from.

Here’s a difference between individual stocks, mutual funds, and ETFs.

Step-By-Step Process to Create PSX Account Online

It is important to have a solid understanding of the basic principles of investing in stocks before Investing in the Pakistan Stock Exchange Online.

When you buy a stock, you are essentially purchasing a small ownership stake in a company. If the company performs well, the value of your stock may increase, giving you the opportunity to earn profits.

However, keep in mind that stocks can also decrease in value, which is why research and strategy are key before investing.

1: Choose a Broker

To invest in the PSX online, you need to sign up with a registered broker who will facilitate your trades.

Brokers act as mediators between investors and the stock exchange.

There are many brokers in Pakistan, and many offer online trading platforms where you can buy and sell shares.

When selecting a broker, consider some factors

- Brokerage fees: The fee they charge for each trade.

- Customer service: A broker that offers good support is helpful, especially for beginners.

- User-friendly platform: Look for an online trading platform that is easy to navigate.

2: Open Account

Once you’ve selected a broker, the next step is to open a brokerage account.

process is simple and requires submitting basic documents like your CNIC and bank statement. Your broker will guide you through the steps, ensuring a smooth account setup.

Make sure all documents are valid to avoid delays and take time to review the terms and conditions to fully understand the account rules.

Some popular online brokers in Pakistan include:

- PSX Online

- AKD Trade

- Faysal Trade

- UBL Trade

Once your account is approved, you can start trading online.

3: Get Verified

Once you’ve opened your trading account, you’ll need to get verified. This involves providing some basic information and documents, such as:

- CNIC

- Passport-sized photo

- Proof of address

4: Fund Your Account

After verification, you’ll need to fund your trading account. You can do this via online banking, ATM, or by visiting your broker’s office.

Be sure to provide accurate account details to avoid any issues. Once the transfer is complete, you’re ready to start investing in the Pakistan Stock Exchange (PSX).

5: Choose Your Stocks

One of the most crucial steps in online trading is research.

Before buying any stocks, take the time to understand the companies you’re investing in. Look at:

- Company performance: Check recent financial reports, profit margins, and revenue growth.

- Industry trends: Understand the industry the company operates in and its future prospects.

- Stock price history: Study the stock’s price fluctuations to spot potential trends.

Now it’s time to start investing!

You can use online resources like PSX’s website or financial news websites to stay up-to-date on market trends.

6: Begin Your Investment Journey

Now that your account is funded and you’ve done your research, it’s time to start trading. You can do this via your broker’s trading platform or customer service.

Provide the company name, number of shares, and your target price. Make sure your details are accurate to ensure correct execution.

Most online platforms offer an easy-to-use interface where you can search for a company, check the stock price, and place your buy or sell orders.

Here are the two main types of orders you can place:

- Market Order: This allows you to buy or sell a stock immediately at the current market price.

- Limit Order: With this order, you set the price at which you want to buy or sell. The trade will only be executed if the stock reaches your specified price.

So, with the right approach, investing in the PSX can be rewarding.

7: Monitor Your Portfolio

Investing in stocks requires patience and a long-term outlook.

Once you’ve made your first investment, your job isn’t done. It’s important to regularly monitor your portfolio and the performance of the stocks you’ve invested in.

After buying shares, regularly monitor your portfolio and stay updated on market conditions and the company’s performance.

This helps you decide whether to hold, sell, or buy more shares.

8: Diversify Your Portfolio

Diversification is a powerful investment strategy that can help you minimize risk and maximize returns.

Instead of investing all your money in a single company, diversify your portfolio by investing in different sectors and companies.

This way, if one company or sector underperforms, the others can make up for it.

9: Be Patient and Stay Informed

Investing in the stock market isn’t a get-rich-quick scheme.

It takes time, patience, and discipline to be a successful investor. Don’t panic if the market dips; don’t get too excited if it goes up.

To be a successful investor, keep an eye on the news, read financial reports, and stay updated with your broker’s research and recommendations.

Is it safe to invest in Pakistan Stock Exchange?

Investing your money where you can get good returns is always a good idea.

However, the stock market offers significant upside potential and has historically provided higher returns compared to other investment options.

Which platform is best for stock trading in Pakistan?

The top stock trading apps in Pakistan are:

- Interactive Brokers: Extremely low fees and a wide range of products.

- Robinhood: Great mobile and web trading platforms. Fast and fully digital account opening.

- MEXEM: Low stock and ETF fees

- Zacks trade: Extensive stock and ETF selection.

- eToro: Free stock and ETF trading. Seamless account opening.

- CapTrader: Low stock and ETF fees. Wide range of products.

What is the Minimum Investment in the Stock Market in Pakistan?

In Pakistan, you can start investing in the stock market with as little as Rs 10,000 per month.

This amount enables you to invest in equities, mutual funds, or ETFs, potentially yielding significant returns through compounding.

The Pakistan Stock Exchange also has a low minimum trade requirement of just one share, and allows net trades of up to PKR 1,000,000 per day.

Disclaimer

Investing in the Pakistan Stock Exchange (PSX), like all stock markets, involves risks, including the potential loss of your invested capital.

Stock prices can fluctuate, and past performance is not a guarantee of future returns.

However, it’s essential to conduct thorough research and consider your risk tolerance before making any investment.

Moreover, you should also seek advice from a financial advisor to ensure that your investment strategy aligns with your financial goals and circumstances.

Final Thoughts

In conclusion, investing in the Pakistan Stock Exchange online is now easier than ever.

However, PSX can be a profitable venture if you approach it with the right mindset and strategy. As well as, do your research, work with a reputable broker, diversify your portfolio, stay updated, and be patient.

Make a smart move and invest in the Pakistan Stock Exchange for a brighter financial future.

Secure Your Tomorrow, Invest Today!