Having a reliable and secure payment gateway is essential for businesses, especially in Pakistan, where online shopping and digital transactions are growing rapidly.

A good payment gateway allows businesses to accept payments easily while ensuring that customers’ transactions are safe.

Are you tired of dealing with payment hassles online?

We have compiled a list of payment gateways in Pakistan that can help vendors receive online payments. Read this guideline and find the best payment gateway.

What are Payment Gateways?

A payment gateway is a service that enables online businesses to accept payments from customers through their website or mobile app.

It acts as a bridge between the customer’s payment method (such as a credit card or bank account) and the merchant’s bank account, facilitating a secure and efficient transaction process.

What is the most used payment method in Pakistan?

The most used payment method in Pakistan is cash, especially for day-to-day transactions. However, with the rise of digital payments, mobile wallets such as JazzCash and EasyPaisa have become increasingly popular for online shopping, bill payments, and money transfers.

Moreover, bank transfers and debit/credit card payments are widely used for e-commerce and more formal transactions. Despite the growing use of digital payments, cash on delivery remains a dominant method for online shopping in Pakistan.

How Digital Payments Are Transforming Pakistan’s Economy

In Pakistan, digital wallets and online payments have become more popular due to the COVID-19 pandemic, which has changed how individuals shop and conduct business.

E-Commerce Market Growth

- User penetration is expected to reach 24.2% in 2023 and rise to 27.3% by 2027.

- Pakistan ranks 46th globally in the eCommerce market, with a projected revenue of US$5.6 billion by 2023, surpassing Romania.

Digital Payment Transactions

- The projected value of digital payment transactions for 2022 is US$8.13 billion.

- It is expected to grow at an annual rate of 16.80% from 2022 to 2027.

Digital Commerce Industry

- Transactional value share of US$7.48 billion as of 2022.

Mobile POS Payments

- Market transaction value is forecasted to reach US$1.67 billion by 2027.

Revenue Growth

- Annual growth rate (CAGR 2023-2027) of 5.93%.

- Projected market volume of US$7,284.00 million by 2027.

The data indicates a significant shift towards digital payments and eCommerce in Pakistan, with substantial growth potential in the coming years.

List of Secure Payment Gateways Offered by Banks in Pakistan

Banks are often the first choice for many when it comes to trade and financial transactions.

Here’s a list of prominent Pakistani banks that provide and support online payment gateways for secure and efficient transactions.

Bank Alfalah Payment Gateway

Bank Alfalah is a leading payment gateway in Pakistan for businesses looking for a versatile and secure solution.

It allows customers to make payments using a variety of methods, including Visa and Mastercard.

Bank Alfalah also offers top-notch security features to protect both the business and the customer.

Key Features

- Supports multiple payment methods, including cards and bank transfers.

- Ideal for both small and large businesses.

- Smooth integration with e-commerce platforms.

- No setup or annual fee

- PCI-DSS compliant platform ensuring top-notch security.

- 3D Secure feature for enhanced protection.

- Instant merchant account setup and easy integration plugins.

- Dedicated vendor dashboard with comprehensive reporting tools.

- Advanced security measures, including fraud detection systems.

- Allows online management of refunds and chargebacks via the merchant portal.

- Supports multiple currencies, enabling customers to pay in their preferred currency.

- Alfa Payment Gateway partners with 7 payment facilitators, including JazzCash and Easypaisa.

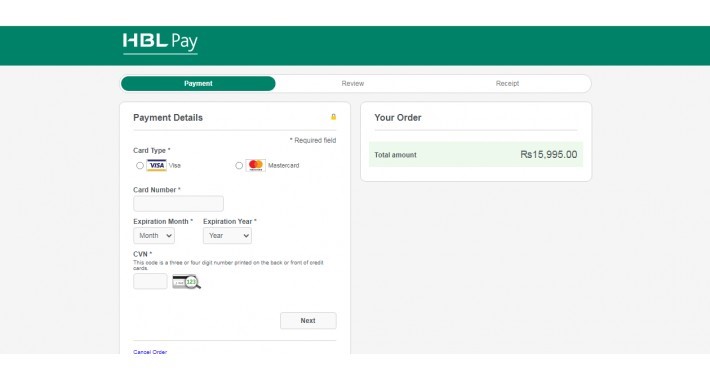

HBL(Habib Bank Limited)

Why HBL Pay?

HBL Pay is a robust payment gateway backed by one of Pakistan’s largest banks.

HBL’s eCommerce Checkout Solution helps merchants transition to a fully digital platform. It allows businesses to connect their Facebook shops, mobile apps, and online stores for seamless online payments.

Merchants can accept payments through Debit, UnionPay, MasterCard, and Visa cards, ensuring they receive payments directly from both local and international customers.

For added security, HBL’s Internet Payment Gateway utilizes the 3D-Secure platform and includes advanced fraud management tools, providing an extra layer of protection for digital transactions.

Key Features:

- Secure and reliable payment processing.

- Accepts payments through debit cards, credit cards, and bank accounts.

- Detailed transaction reports and tracking.

- Supports various currencies for international transactions.

- A dedicated Merchant Portal that displays and provides access to features like transaction history, search, refunds, and reports

- Customers can pay in their preferred currency, enhancing convenience and flexibility.

- Regular customers can easily use their saved information for future purchases, streamlining the checkout process.

- Vendors can access custom-made reports with over 300 data fields, providing valuable insights for marketing analysis.

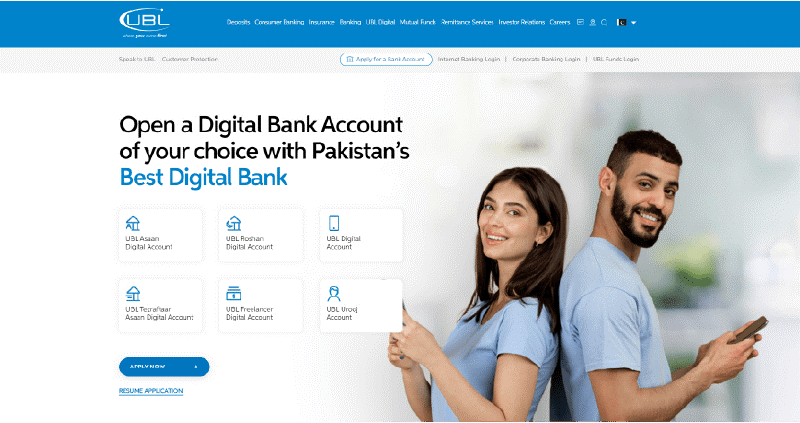

UBL (United Bank Limited)

United Bank Limited (UBL) is a leading name in Pakistan’s banking sector and is renowned for its online payment gateway services.

As a pioneer in the financial industry, UBL has been facilitating digital payments since 2013, and its services are backed by Etisalat UAE.

With UBL’s e-Commerce Payment Gateway, businesses can seamlessly accept online payments.

Simply set up your merchant account, and you’ll be equipped to handle transactions efficiently from day one.

Key Features

- Ensures maximum safety for transactions.

- PCI-DSS Certified, Secure platform for transactions.

- Seamless setup and adjustment.

- Enhances user experience on both desktop and mobile.

- Provides a frictionless payment experience.

- Securely saves card information.

- Protects against fraud risk.

- Multiple Payment Options: Includes credit, debit cards, and direct debit.

- Allows vendors to receive payments without gateway integration, ideal for social media-based businesses.

Comparing Charge Summaries of Different Payment Gateways in Pakistan

| Payment Gateway | Set-up fee | Recurring Fee per Year | Transaction Fee | Merchant Discount Rate |

| Alfalah | None | 40,000 | None | 2.5% |

| MCB | 50,000 | 48,000 | 15 | 2.8% |

| HBL | 40,000 | 40,000 | None | 2.5% |

| UBL | 40,000 | 50,000 | None | 3.5% |

Best FinTech Payment Solutions in Pakistan

When it comes to digital payments in Pakistan, banks aren’t the only choice. There are various FinTech businesses that operate as successful payment gateway providers.

JazzCash

JazzCash is a leading online payment gateway in Pakistan, widely used by both individuals and businesses.

As of 2024, JazzCash has over 15 million active users, making it one of the most trusted gateways in the country.

JazzCash offers a user-friendly, secure platform for transactions, allowing account creation via mobile and CNIC numbers. Businesses can utilize the JazzCash Corporate Package, receive payments via QR codes, and process transactions through cards, mobile accounts, and direct debit options.

It also uses advanced encryption and 3D secure authentication. Moreover, Accepts multiple payment methods, including credit/debit cards and mobile wallets.

Key Features

- Accepts payments via mobile wallets and bank transfers.

- Easy integration with e-commerce websites.

- User-friendly mobile app for both merchants and customers.

- 24/7 customer support.

Fee: There are no annual, monthly, or setup charges to use JazzCash Online Payment Gateway.

EasyPaisa

EasyPaidsa is accepted by over 100,000 merchants across Pakistan. It is also one of the best payment gateways in Pakistan which is powered by Telenor in 2009.

As of 2021, 25 million registered wallets and 8 million active users. It offers reliable digital financial services, facilitating quick cash transfers.

However, EasyPaisa is widely used for supply chain payments, cash management, and salaries by major enterprises like Daraz and HumMart. Its user-friendly registration and seamless onboarding process set it apart.

Key Features:

- Supports mobile wallets, credit cards, and bank transfers.

- Seamless integration with online stores and platforms.

- Cash-on-delivery options for e-commerce businesses.

- Multi-language customer support.

Fee: 1.75% (incl. Tax) of the transaction amount.

Payoneer

Payoneer supports transactions in over 200 countries and territories, allowing businesses to accept payments from international clients with ease.

It handles multiple currencies, enabling you to receive payments in different currencies and convert them at competitive exchange rates.

The platform integrates smoothly with various eCommerce and online marketplaces, simplifying the payment process for businesses.

Moreover, Payoneer provides a prepaid MasterCard, which can be used for online and in-store purchases or ATM withdrawals.

Fee: 3% for credit card transactions (all currencies). 1% for ACH bank debit transactions. 0% to receive payments from other Payoneer users’ account balances

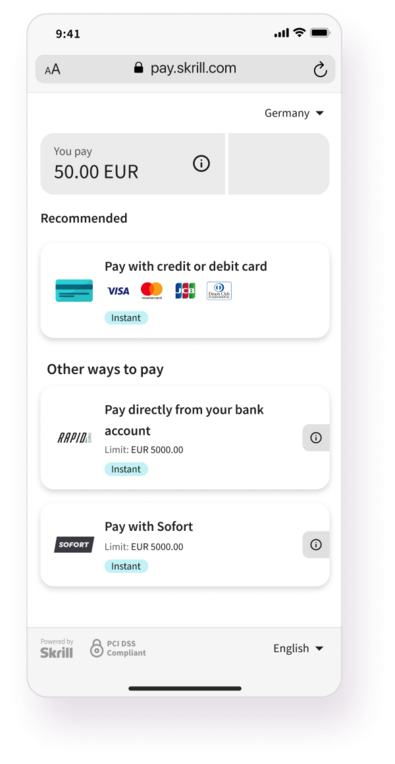

Skrill

Although Skrill is an international payment gateway, it’s widely used in Pakistan for online transactions, especially for freelancers and international businesses.

Skrill offers a fast, low-cost, and secure way to transfer money across borders, making it a preferred option for those working with international clients.

Key Features:

- Fast and low-cost money transfers.

- Secure and reliable with strong encryption.

- Ideal for freelancers and international businesses.

Fee: 2.50%

How can we integrate online payments in Pakistan?

You can easily integrate online payments in Pakistan using plugins and APIs.

Almost all payment gateways are compatible with websites and mobile apps.

How to Choose the Right Payment Gateway?

When selecting a payment gateway, consider:

- Security: Ensure the gateway uses advanced encryption and authentication.

- Fees: Compare fees among gateways to save on transaction costs.

- Integration: Choose a gateway with easy API integration.

- Acceptance: Consider the gateway’s acceptance rate and availability.

Conclusion

Choosing the right payment gateway is crucial for the success of your business.

The above-mentioned payment gateways are secure, efficient, and well-suited to the Pakistani market.

Whether you’re a small business owner or a large enterprise, these options offer flexibility and security to help you grow your business online.

So, explore your options today and find the perfect gateway!